tucson sales tax rate change

Effective July 01 2016 the per room per night surcharge will be 4. 19-01 to increase the following tax rates.

State And Local Taxes In Arizona Lexology

On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

. Tucson Estates AZ Sales Tax Rate. As of March 1 2018 the local tax rate in Tucson is 26 on the following business classifications. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Tucson AZ.

Effective July 01 2009 the per room per night surcharge will be 2. A 1500 refrigerator purchased in. Effective July 1 2017 the rate will rise from 20 to 25.

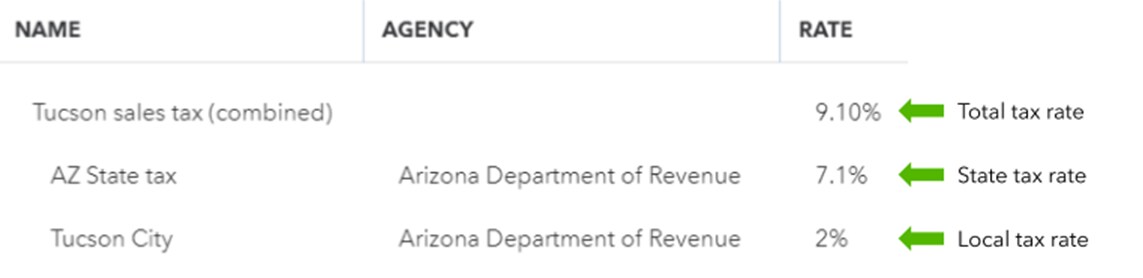

Accordingly effective february 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in tucson. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Tucson is in the following zip codes.

Did South Dakota v. The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most business activities and increased effective March 1 2018 from 25 to 26 for those same business activities. Tumacacori AZ Sales Tax Rate.

Tucson Sales Tax Rates for 2022 Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. City of South Tucson Tax Code effective 10-01-2019 150 KB Summary of. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

860 Is this data incorrect Download all Arizona sales tax rates by zip code. As UA is exempt from the. Arizona Sales Tax Rates By City County 2022 State And Local Sales Taxes In 2012 Tax Foundation Tucson.

Vail az sales tax rate. The Tucson sales tax rate is 26. Has impacted many state nexus laws and sales.

4 rows The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County. Sales Tax Breakdown Tucson Details Tucson AZ is in Pima County. Sales Tax Rates in Tucson and Pima County Sales Tax Transaction Privilege Tax As the result of a Special Election held on November 7 2017 Mayor and Council adopted.

The December 2020 total local sales tax rate was also 8700. 85701 85702 85703. On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate.

The 2018 United States Supreme Court decision in South Dakota v. Retail Sales 017 to five percent 50. If you need to buy a big-ticket item say a new refrigerator you could save some money by buying where the sales tax is lower.

8 rows Lowered from 76 to 66. 801 Average Sales Tax Summary The average cumulative sales tax rate in Tucson Arizona is 801. Parker Salome Ehrenberg Bouse Wenden and Cibola.

The County sales tax rate is 0. Amusements Commercial rental leasing and licensing for use. Wayfair Inc affect Arizona.

Method to calculate Tucson sales tax in 2021. The Tucson Arizona sales tax is 860 consisting of. As the result of a Special Election held on November 7 2017 Mayor and Council adopted.

This includes the rates on the state county city and special levels. Tubac AZ Sales Tax Rate. The attached pdf contains the most recent changes to City Code Chapter 11 related to tax rates and license fees.

Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87. Tucson AZ Sales Tax Rate. Effective July 01 2003 the tax rate increased to 600.

This is especially important to note if you are an annual filer as the city tax rate has. Tucson sales tax rate change Monday February 14 2022 Edit. The Arizona sales tax rate is currently 56.

TAX RATE CHANGES EFFECTIVE FEBRUARY 1 2018. The current total local sales tax rate in Tucson AZ is 8700.

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Arizona Senate Oks Changing Vehicle License Tax Formula Govt And Politics Tucson Com

Property Taxes In Arizona Lexology

Use Custom Rates To Manually Calculate Taxes On Invoices Or Receipts

Arizona Sales Tax Rates By City County 2022

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

How To Calculate Sales Tax Video Lesson Transcript Study Com

State And Local Taxes In Arizona Lexology

Rate And Code Updates Arizona Department Of Revenue

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

State And Local Sales Taxes In 2012 Tax Foundation

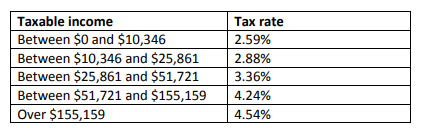

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia